The Growing Market For Voluntary Carbon Credits

Carbon Credits

The market for carbon credits has been around for roughly 25 years. But, while many people have heard of it, few know what it is, how it works or its role in fighting global warming. As more companies pledge to become “carbon-neutral” or even “net zero,” interest in carbon markets is surging, and it’s expected to keep growing. In fact, according to a new report from the Taskforce on Scaling Voluntary Carbon Markets (TSVCM), the carbon credit market’s value could reach $50 billion by 2030.

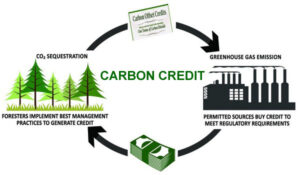

Carbon credits represent quantities of greenhouse gases kept out of the atmosphere or removed from it. The credits are used by companies or individuals who wish to offset their own emissions or match the footprint of a project they’re supporting, such as a wind farm or solar power plant. A credit can be traded for the equivalent of one metric ton of CO2 or other greenhouse gas. Upon retirement, the credits are no longer tradable.

In the voluntary market, which is unregulated by governments and has a smaller footprint than compliance markets, projects generate trade carbon credits through reductions that would have occurred anyway. These projects can be nature-based, such as reforestation or a wetland restoration, or technology-based, such as direct air capture or carbon dioxide storage. In addition, a carbon credit may be generated by a project that voluntarily seeks independent verification of its emission-reduction achievements or adheres to programs like the Verified Carbon Standard or Gold Standard.

The Growing Market For Voluntary Carbon Credits

Because the carbon market is so diverse, buyers and suppliers have a wide range of options for where to buy and sell carbon credits. Buyers can choose to purchase credits through carbon-credit exchanges or buy them directly from a project. There are also a number of national and international carbon pricing programs, such as the Clean Development Mechanism, Article 6 of the Paris Agreement and the CORSIA program.

As carbon prices rise, so too does the demand for credits. This has led to an increase in the number of carbon-credit trading platforms, brokers and financial firms that offer a variety of services. Some offer both brokering and financing, while others specialize in project development or have a dedicated trading arm. Similarly, some of the bigger exchanges operate multiple carbon-credit product lines to accommodate buyers and sellers with different preferences for how they want to trade.

The market for carbon credits is a complicated and volatile one. Because of this, it’s important for buyers and suppliers to have a clear understanding of the credits they’re dealing with. This is why Platts’ market-leading Price Indices for carbon credits were created. By defining quality features for the various types of carbon credits, these indices help buyers and suppliers find each other quickly and efficiently. They provide a standard way of describing how quality attributes like emissions-reduction methodologies and co-benefits are verified, and make it easier for buyers and sellers to find the right matches. The indexes are based on bid and offer prices reported in the Platts carbon market.