Carbon Credits and Trade Finance

Carbon Credits and Trade

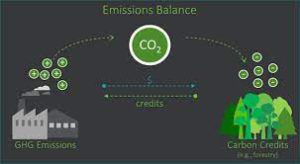

Purchasing carbon credits, whether on a global, regional, or local level, can be an important step in reducing greenhouse gas emissions. Carbon credits are financial products that are issued to companies and individuals who wish to offset their environmental footprints. They serve as a permission slip, allowing companies to take the necessary steps to limit their carbon dioxide emissions.

carbon trading markets are emerging as a response to the growing global climate crisis. In recent years, carbon trading markets have expanded both globally and locally. Some of these markets are regulated and some are voluntary. Both rely on a set of standards and regulations.

Regulated markets are controlled by governmental bodies, and they generally trade only in carbon allowances. For example, in the United States, the California cap-and-trade program is a regulated market. Companies covered by the program may purchase a certain amount of carbon credits, based on their electricity and gas consumption. The company will then be able to sell excess credits to other participants, if needed. This allows the state to meet its annual emission goals, while also providing a monetary incentive for companies to invest in cleaner technologies.

Carbon Credits and Trade Finance

Voluntary markets are not regulated, but are open to anyone who wants to participate. These markets are driven by companies’ desire to achieve net-zero targets, as well as by increased consumer interest in the environment. However, the success of a voluntary carbon market depends on a variety of factors, such as increased regulatory oversight, improved participant eligibility, and more robust data infrastructure.

A key challenge for developing market-based carbon funding schemes is identifying a standardized product. Non-standardized products are more likely to attract a higher price on the open market, while standardized products are generally preferred by financial players.

Market-based funding mechanisms can help ensure that countries have a steady source of funding for REDD+. Although some advocates believe that REDD+ should be included in any trading scheme, others argue that it should be separated from carbon trading. While some market-based funding mechanisms will generate non-additional carbon emissions, they could also create a large number of non-additional emissions from developing nations.

Another type of market-based carbon funding mechanism is a dedicated fund. Typically, these funds are supported by countries such as China and Brazil. These funds avoid the need to estimate the quantity of carbon saved through a REDD+ initiative. These funds also avoid the need for hard-to-determine baseline data, and they also avoid the likelihood of a carbon market that would be distorted by this approach.

Depending on the region, a cap-and-trade system can create an exchange value for emissions, and the volume of credits that are traded at a particular time determines the market price. Cap-and-trade programs typically impose a cap on total carbon emissions that are emitted each year, with the cap dropping over time. As a result, companies with lower emissions can sell allowances to companies with higher emissions.

A key benefit of a market-based funding mechanism is the ability to make sure that the scheme is flexible enough to accommodate the needs of different countries. In the case of a carbon credit system, the demand for carbon credits is expected to grow dramatically.